Do you have a trouble to find 'assignment and assumption of membership interest form'? You will find your answers right here.

Table of contents

- Assignment and assumption of membership interest form in 2021

- Assignment of llc interest tax consequences

- Assignment of membership interest form

- Membership interests examples

- Assignment of membership interest sample

- Assignment of membership interest real estate

- Assignment of membership interest sec

- Assignment of llc interest to trust

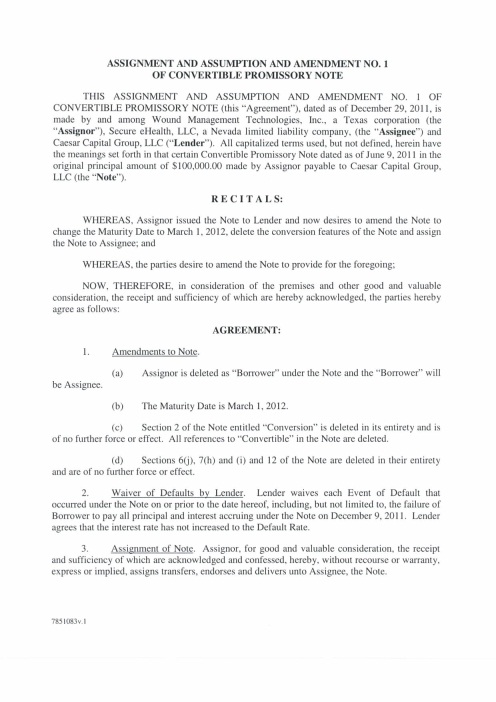

Assignment and assumption of membership interest form in 2021

This image representes assignment and assumption of membership interest form.

This image representes assignment and assumption of membership interest form.

Assignment of llc interest tax consequences

This image shows Assignment of llc interest tax consequences.

This image shows Assignment of llc interest tax consequences.

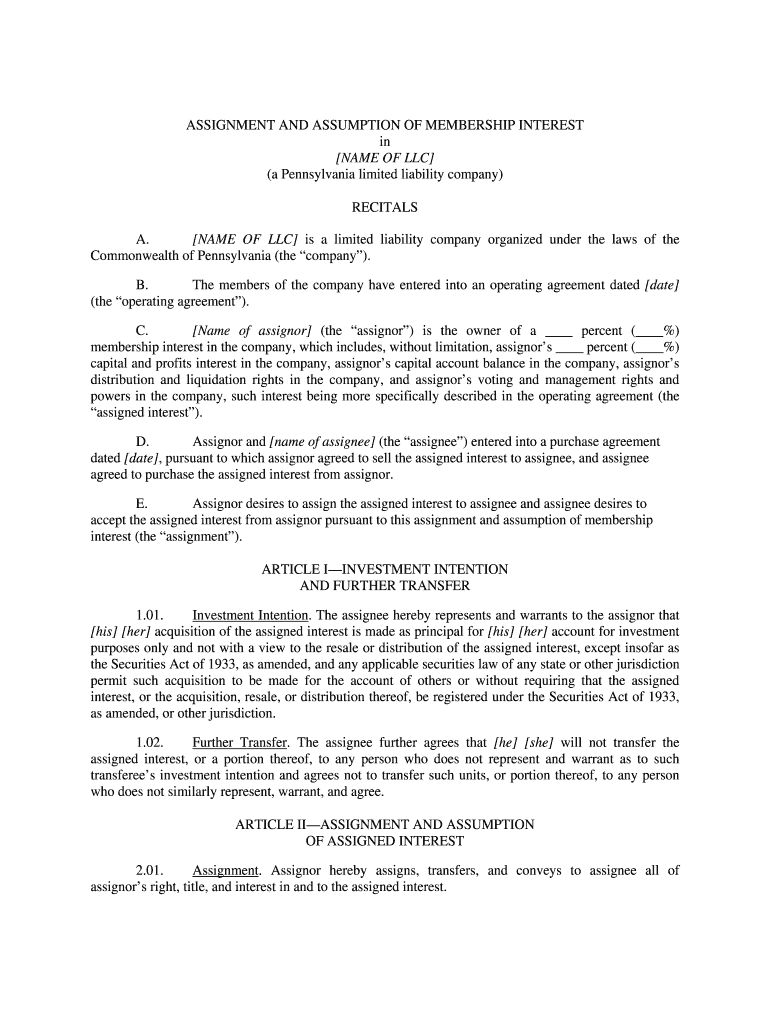

Assignment of membership interest form

This picture demonstrates Assignment of membership interest form.

This picture demonstrates Assignment of membership interest form.

Membership interests examples

This image illustrates Membership interests examples.

This image illustrates Membership interests examples.

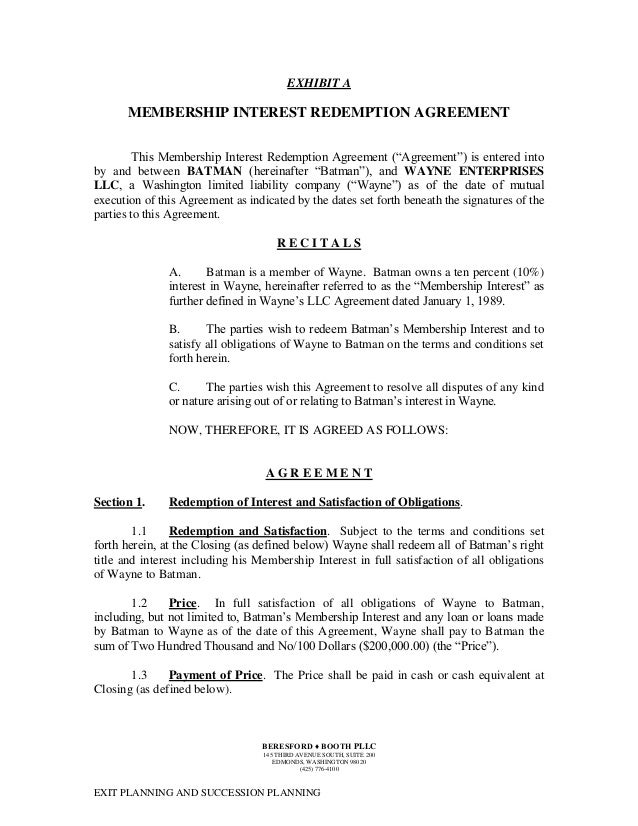

Assignment of membership interest sample

This image demonstrates Assignment of membership interest sample.

This image demonstrates Assignment of membership interest sample.

Assignment of membership interest real estate

This picture demonstrates Assignment of membership interest real estate.

This picture demonstrates Assignment of membership interest real estate.

Assignment of membership interest sec

This image demonstrates Assignment of membership interest sec.

This image demonstrates Assignment of membership interest sec.

Assignment of llc interest to trust

This image demonstrates Assignment of llc interest to trust.

This image demonstrates Assignment of llc interest to trust.

When was the assignment and Assumption of membership interests made?

OF MEMBERSHIP INTERESTS (Pellissippi Pointe, L.L.C.) THIS ASSIGNMENT AND ASSUMPTION OF MEMBERSHIP INTERESTS (this “Assignment”) is dated as of June 24, 2011, by and among [ASSIGNOR] (“Assignor”) and MILLER ENERGY RESOURCES, INC., a Tennessee corporation (the “Assignee”), recites and provides as follows:

When does an assignor have no obligations or liabilities?

From and after the date hereof, the Assignor shall not have any obligations or liabilities with respect to (i) the Assigned Interest, including without limitation, the 1

When does a LLC Membership interest assignment occur?

An LLC Membership Interest Assignment normally happens well after the LLC has already been operating. To form a limited liability company in most states, any party must begin with Articles of Organization (sometimes called Certificates of Formation or other varying names).

How does the assignment and Assumption Agreement work?

WHEREAS, the Assignor proposes to assign, transfer and sell to Assignee a twenty-four percent (24.0%) Membership Interest in the Company (the “Assigned Interest”) by the execution and delivery of this Assignment and Assumption Agreement.

Last Update: Oct 2021